1.1 Is my company a “reporting company”?

1.2 Is my company exempt from the reporting requirements?

1.3 What happens if my company does not report BOI in the required timeframe?

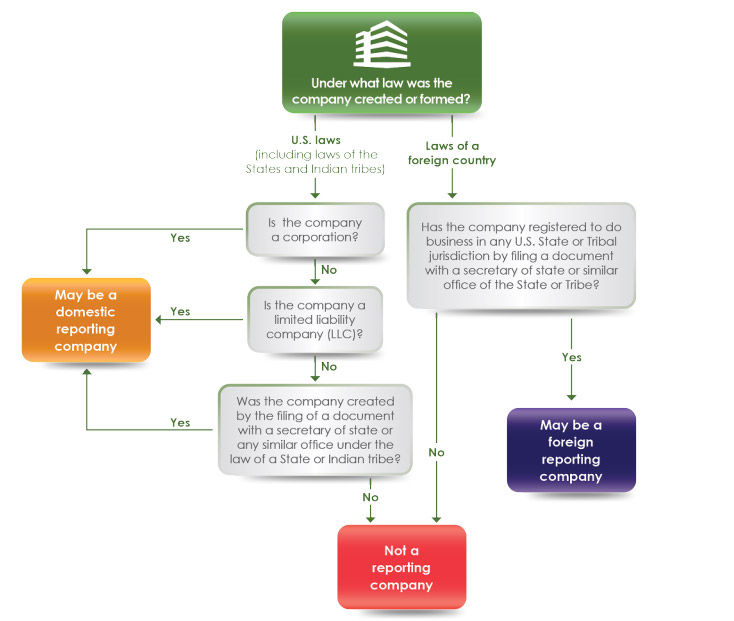

The Reporting Rule requires that all “reporting companies” file BOI reports with FinCEN within the previously specified timeframes. A reporting company is any entity that meets the “reporting company” definition and does not qualify for an exemption. There are two categories of reporting companies: a “domestic reporting company” and a “foreign reporting company”. If your company is neither a “domestic reporting company” nor “foreign reporting company” because it does not meet either definition (as described below) or it qualifies for an exemption, then it is not required to file a BOI report with FinCEN.

FYI

- States means any State of the United States, the District of Columbia, the Commonwealth of Puerto Rico, the Commonwealth of the Northern Mariana Islands, American Samoa, Guam, the United States Virgin Islands, and any other commonwealth, territory, or possession of the United States.

- Indian tribes means any Indian or Alaska Native tribe, band, nation, pueblo, village or community that the Secretary of the Interior acknowledges to exist as an Indian tribe. (See section 102 of the Federally Recognized Indian Tribe List Act of 1994 (25 U.S.C. 5130)).

Special rule for foreign pooled investment vehicles.

See special rule at 1010.380(b)(2)(iii)

1. The entity is an issuer of a class of securities registered

under section 12 of the Securities Exchange Act of 1934 (15 U.S.C. 78l).

1. The entity is a “bank” as defined in section 3 of the Federal Deposit Insurance Act (12 U.S.C. 1813).

2. The entity is a “bank” as defined in section 2(a) of the Investment Company Act of 1940 (15 U.S.C. 80a-2(a)).

3. The entity is a “bank” as defined in section 202(a) of the Investment Advisers Act of 1940 (15 U.S.C. 80b-2(a)).

An entity qualifies for this exemption if either of the following two criteria apply:

1. The entity is a “Federal credit union” as defined in section 101 of the Federal Credit Union Act (12 U.S.C. 1752).

2. The entity is a “State credit union” as defined in section 101 of the Federal Credit Union Act (12 U.S.C. 1752).

1. The entity is a “bank holding company” as defined in section 2 of the Bank Holding Company Act of 1956 (12 U.S.C. 1841).

2. The entity is a “savings and loan holding company” as defined in section 10(a) of the Home Owners’ Loan Act (12 U.S.C. 1467a(a)).

1. The entity is a money transmitting business registered with FinCEN under 31 U.S.C. 5330.

2. The entity is a money services business registered with FinCEN under 31 CFR 1022.380.

An entity qualifies for this exemption if both of the following criteria apply:

1. The entity is a “broker” or “dealer,” as those terms are defined in section 3 of the Securities Exchange Act of 1934 (15 U.S.C. 78c).

2. The entity is registered under section 15 of the Securities Exchange Act of 1934 (15 U.S.C. 78o).

1. The entity is an “exchange” or “clearing agency,” as those terms are defined in section 3 of the Securities Exchange Act of 1934 (15 U.S.C. 78c).

2. The entity is registered under sections 6 or 17A of the Securities Exchange Act of 1934 (15 U.S.C. 78f, 78q-1).

An entity qualifies for this exemption if both of the following criteria apply:

2. The entity is registered with the Securities and Exchange Commission under the Securities Exchange Act of 1934 (15 U.S.C. 78a et seq.).

1. The entity is an “investment company” or “investment adviser” defined as either:

- An investment company in section 3 of the Investment Company Act of 1940 (15 U.S.C. 80a-3); or

- An investment adviser in section 202 of the Investment Advisers Act of 1940 (15 U.S.C. 80b-2).

2. The entity is registered with the Securities and Exchange Commission under either of these authorities:

- The Investment Company Act of 1940 (15 U.S.C. 80a-1 et seq.); or

- The Investment Advisers Act of 1940 (15 U.S.C. 80b-1 et seq.).

1. The entity is an investment adviser that is described in section 203(l) of the Investment Advisers Act of 1940 (15 U.S.C. 80b-3(l)).

1. The entity is an “insurance company” as defined in section 2 of the Investment Company Act of 1940 (15 U.S.C. 80a-2).

1. The entity is a “registered entity” as defined in section 1a of the Commodity Exchange Act (7 U.S.C. 1a).

2. The entity is one of these entities registered with the Commodity Futures Trading Commission under the Commodity Exchange Act:

- “Futures commission merchant” as defined in section 1a of the Commodity Exchange Act (7 U.S.C. 1a);

- “Introducing broker” as defined in section 1a of the Commodity Exchange Act (7 U.S.C. 1a);

- “Swap dealer” as defined in section 1a of the Commodity Exchange Act (7 U.S.C. 1a);

- “Major swap participant” as defined in section 1a of the Commodity Exchange Act (7 U.S.C. 1a);

- “Commodity pool operator” as defined in section 1a

of the Commodity Exchange Act (7 U.S.C. 1a); - “Commodity trading advisor” as defined in section

1a of the Commodity Exchange Act (7 U.S.C. 1a);

or - “Retail foreign exchange dealer” as described in section 2(c)(2)(B) of the Commodity Exchange Act (7 U.S.C. 2(c)(2)(B)).

An entity qualifies for this exemption if the following criterion applies:

1. The entity is a public accounting firm registered in accordance with section 102 of the Sarbanes-Oxley Act of 2002 (15 U.S.C. 7212).

An entity qualifies for this exemption if both of the following criteria apply:

1. The entity is a “regulated public utility” as defined in 26 U.S.C. 7701(a)(33)(A).

2. The entity provides telecommunications services, electrical power, natural gas, or water and sewer services within the United States.

1.The entity is a financial market utility designated by the Financial Stability Oversight Council under section 804 of the Payment, Clearing, and Settlement Supervision Act of 2010 (12 U.S.C. 5463).

An entity qualifies for this exemption if both of the following criteria apply:

1. The entity is a pooled investment vehicle if either of these statements apply to the entity:

- Is an investment company, as defined in section 3(a) of the Investment Company Act of 1940 (15 U.S.C. 80a-3(a); or

- Is a company that would be an investment company under that section but for the exclusion provided from that definition by paragraph (1) or (7) of section 3(c) of that Act (15 U.S.C. 80a-3(c)); and is identified by its legal name by the applicable investment adviser in its Form ADV, (or successor form) filed with the Securities and Exchange Commission or will be so identified in the next annual updating amendment to Form ADV required

to be filed by the applicable investment adviser pursuant to rule 204-1 under the Investment Advisers Act of 1940 (17 CFR 275.204-1).

- Bank, as defined in Exemption #3;

- Credit union, as defined in Exemption #4;

- Broker or dealer in securities, as defined in Exemption #7;

- Investment company or investment adviser, as defined in Exemption #10; or

- Venture capital fund adviser, as defined in Exemption #11.

An entity qualifies for this exemption if any of the following four criteria apply:

1.The entity is an organization that is described in section 501(c) of the Internal Revenue Code of 1986 (Code) (determined without regard to section 508(a) of the Code) and exempt from tax under section 501(a) of the Code.

4.The entity is a trust described in paragraph (1) or (2) of section 4947(a) of the Code.

An entity qualifies for this exemption if all four of the following criteria apply:

2.The entity is a United States person as defined in section 7701(a)(30) of the Internal Revenue Code of 1986.

3. The entity is beneficially owned or controlled exclusively by one or more United States persons that are United States citizens or lawfully admitted for permanent residence. “Lawfully admitted for permanent residence” is defined in section 101(a) of the Immigration and Nationality Act (8 U.S.C. 1101(a)).

An entity qualifies for this exemption if all six of the following criteria apply:

2. More than 20 full-time employees of the entity are employed in the “United States,” as that term is defined in 31 CFR 1010.100(hhh).

4. The entity entity filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales. If the entity is part of an affiliated group of corporations within the meaning of 26 U.S.C. 1504, refer to the consolidated return for such group.

5. The entity reported this greater-than-$5,000,000 amount as gross receipts or sales (net of returns and allowances) on the entity’s IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form.

An entity qualifies for this exemption if the following criterion applies:

- Securities reporting issuer, as defined in Exemption #1;

- Governmental authority, as defined in Exemption #2;

- Bank, as defined in Exemption #3;

- Credit union, as defined in Exemption #4;

- Depository institution holding company, as defined in Exemption #5;

- Broker or dealer in securities, as defined in Exemption #7;

- Other Exchange Act registered entity, as defined in Exemption #9;

- Investment company or investment adviser, as defined in Exemption #10;

- Venture capital fund adviser, as defined in Exemption #11;

- Insurance company, as defined in Exemption #12;

- State-licensed insurance producer, as defined in Exemption #13;

- Commodity Exchange Act registered entity, as defined in Exemption #14;

- Accounting firm, as defined in Exemption #15;

- Public utility, as defined in Exemption #16;

- Financial market utility, as defined in Exemption #17;

- Tax-exempt entity, as defined in Exemption #19; or

- Large operating company, as defined in Exemption #21.

Inactive entity (Exemption #23)

An entity qualifies for this exemption if all six of the following criteria apply:

3.The entity is not owned by a foreign person, whether directly or indirectly, wholly or partially. “Foreign person” means a person who is not a United States person. A United States person is defined in section

7701(a)(30) of the Internal Revenue Code of 1986 as a citizen or resident of the United States, domestic partnership and corporation, and other estates and trusts.

FinCEN is issuing this Guide and other guidance, as well as conducting outreach, to ensure that all reporting companies are aware of their reporting obligations, including their obligations to update or correct beneficial ownership information. If a person has reason to believe that a report filed with FinCEN contains inaccurate information and voluntarily submits a report correcting the information within 90 days of the deadline for the original report, then the Corporate Transparency Act creates a safe harbor from penalty. However, should a person willfully fail to report complete or updated beneficial ownership information to FinCEN as required under the Reporting Rule, FinCEN will determine the appropriate enforcement response in consideration of its published enforcement factors.

The willful failure to report complete or updated beneficial ownership information to FinCEN, or the willful provision of or attempt to provide false or fraudulent beneficial ownership information may result in a civil or criminal penalties, including civil penalties of up to $500 for each day that the violation continues, or criminal penalties including imprisonment for up to two years and/or a fine of up to $10,000. Senior officers of an entity that fails to file a required BOI report may be held accountable for that failure.

Providing false or fraudulent beneficial ownership information could include providing false identifying information about an individual identified in a BOI report, such as by providing a copy of a fraudulent identifying document

Additionally, a person may be subject to civil and/or criminal penalties for willfully causing a company not to file a required BOI report or to report incomplete or false beneficial ownership information to FinCEN.

For example, an individual who qualifies as a beneficial owner or a company applicant might refuse to provide information, knowing that a company would not be able to provide complete beneficial ownership information to FinCEN without it. Also, an individual might provide false information to a company, knowing that information is meant to be reported to FinCEN.