Only certain reporting companies must include information about their company applicants in their BOI reports. This chapter has two sections to help your company determine whether the requirements apply and, if so, how to identify its company applicants:

- 3.1 Is my company required to report its company applicants?

- 3.2 Who is a company applicant of my company?

This chapter generally covers 1010.380(e),“Company applicant”

This chapter generally covers 1010.380(e),“Company applicant”

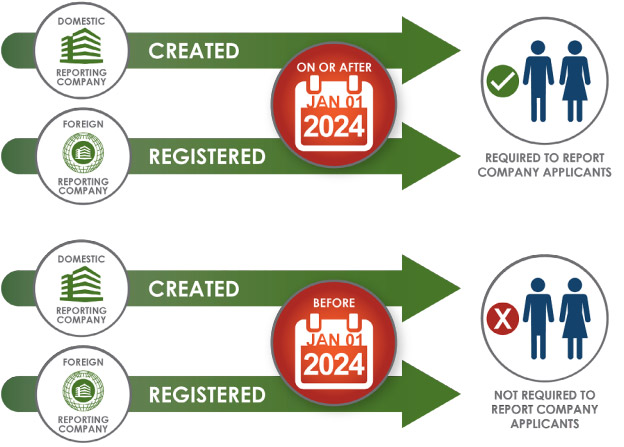

A reporting company is required to report its company applicants if it is either a:

- domestic reporting company created on or after January 1, 2024; or

- foreign reporting company first registered to do business in the United States on or after January 1, 2024.

A reporting company is not required to report its company applicants if it is either a:

- domestic reporting company created before January 1, 2024; or

- foreign reporting company first registered to do business in the United States before January 1, 2024.

Chart 5 – Company applicant reporting requirement

The special rule concerning company applicant reporting can be found at 1010.380(b)(2)(iv) and is discussed further in the next chapter (section 4.2).

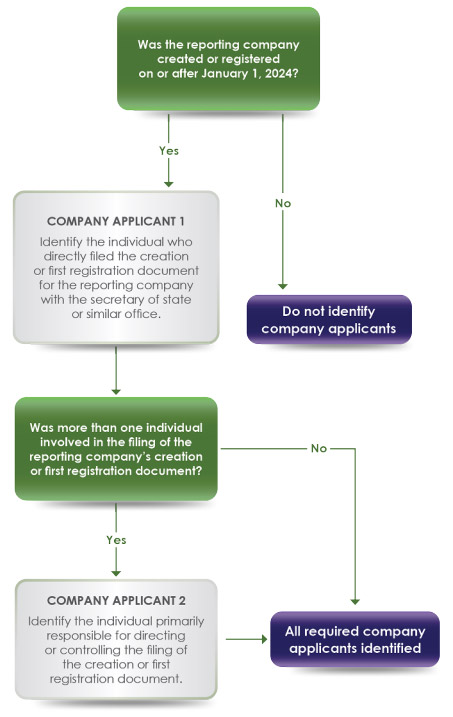

Each reporting company that is required to report company applicants will have to identify and report to FinCEN at least one company applicant, and at most two. All company applicants must be individuals. Companies or legal entities cannot be company applicants.

There are two categories of company applicants – the “direct filer” and the individual who “directs or controls the filing action.”

- The first category (direct filer) must be identified by all reporting companies that have a company applicant reporting requirement.

- The second category (directs or controls the filing action) may not be applicable to all reporting companies that have a company applicant reporting requirement. The second category of company applicants is only required to be reported when more than one individual is involved in the filing of the document that created or first registered the company.

- If more than one individual is involved in the filing, then two company applicants must be reported.

- No reporting company will have more than two company applicants.

Company Applicant Category 1: Direct filer

This is the individual who directly filed the document that created a domestic reporting company, or the individual who directly filed the document that first registered a foreign reporting company. This individual would have actually physically or electronically filed the document with the secretary of state or similar office.

Company Applicant Category 2: Directs or controls the filing action

The other possible company applicant is the individual who was primarily responsible for directing or controlling the filing of the creation or first registration document. This individual is a company applicant even though the individual did not actually file the document with the secretary of state or similar office.

Chart 6 – Company application definition

The following examples illustrate how to identify company applicants in common company creation or registration scenarios.

Example 1: Individual A is creating a new company. Individual A prepares the necessary documents to create the company and files them with the relevant State or Tribal office, either in person or using a self-service online portal. No one else is involved in preparing, directing, or making the filing

Individual A is a company applicant because Individual A directly filed the document that created the company. Because Individual A is the only person involved in the filing, Individual A is the only company applicant. State or Tribal employees who receive and process the company creation or formation documents should not be reported as company applicants

Example 2: Individual A is creating a company. Individual A prepares the necessary documents to create the company and directs Individual B to file the documents with the relevant State or Tribal office. Individual B then directly files the documents that create the company.

Individuals A and B are both company applicants – Individual B directly filed the documents, and Individual A was primarily responsible for directing or controlling the filing. Individual B could, for example, be Individual A’s spouse, business partner, attorney, or accountant; in all cases, Individuals A and B are both company applicants in this scenario.